Safeguarding Your Finances

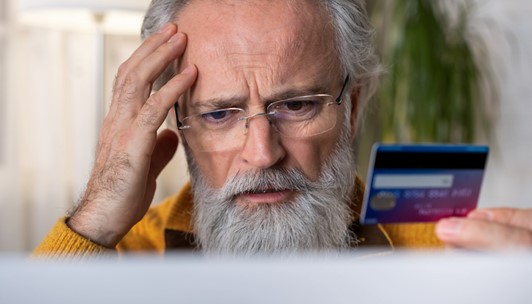

Staying Vigilant Against Bank Scams

In today's interconnected world, where online transactions and digital banking have become the norm, protecting our financial information is paramount. Unfortunately, the rise in technological advancements has also given rise to various bank scams that aim to exploit unsuspecting individuals. At Legacy Bank, we are committed to ensuring the security and well-being of our customers. In this article, we will shed light on common bank scams, how to recognize them, and the steps you can take to address and prevent them.

1. Phishing Scams

Phishing scams involve fraudulent attempts to obtain sensitive information such as usernames, passwords, or credit card details by impersonating legitimate institutions. Here's how to recognize and address phishing scams:

- Be cautious of unsolicited emails or messages asking for personal information.

- Verify the authenticity of any communication by contacting your bank directly through official channels.

- Never click on suspicious links or download attachments from unknown sources.

- Report any phishing attempts to your bank immediately.

2. Fake Websites and Cloned Apps

Scammers often create fake websites or clone legitimate banking apps to deceive users into providing their login credentials. Stay vigilant with these tips:

- Double-check the URL of the website before entering any sensitive information.

- Download mobile banking apps only from authorized sources such as official app stores.

- Regularly update your apps to ensure you have the latest security patches.

- If you suspect a fake website or app, report it to your bank and the appropriate authorities.

3. Identity Theft

Identity theft involves stealing personal information to gain unauthorized access to financial accounts. Protect yourself by following these guidelines:

- Safeguard your personal information, such as social security numbers and account details.

- Regularly monitor your bank statements and credit reports for any unusual activity.

- Enable two-factor authentication for your accounts whenever possible.

- If you suspect identity theft, immediately contact your bank, credit bureaus, and local law enforcement.

4. Money Transfer and Investment Scams

Scammers may pose as individuals or organizations offering lucrative investment opportunities or requesting money transfers. Stay cautious with these steps:

- Exercise due diligence before investing or transferring funds. Research and verify the legitimacy of the opportunity or individual.

- Be skeptical of promises of high returns with minimal risk.

- Do not share your financial information with unknown individuals or entities.

- If you suspect a scam, report it to your bank and relevant regulatory authorities.

Legacy Bank is committed to protecting its customers from bank scams, but your vigilance and awareness are crucial. By staying informed about common scams and implementing preventive measures, you can safeguard your finances and personal information.

Remember, if you encounter any suspicious activity or believe you have fallen victim to a bank scam, contact your bank immediately. Together, we can create a safer banking environment for everyone.

Legacy Bank. Grow with us, Generation after Generation